The API Problem in Travel Distribution

For a decade, B2B travel companies optimized for channel presence. Get on Expedia. Get on Booking. Build wholesale relationships. Manage rate parity across GDS, bed banks, and direct connections.

The logic was simple: more channels, more volume.

But volume at what cost?

Commissions compress margins. Customer data stays trapped. Visibility gets dictated by someone else's algorithm. And when you scale across channels, you inherit their constraints—slow updates, rigid formats, manual reconciliation.

The constraint isn't access anymore. It's architecture.

The Quiet Shift

Something changed in the last 18 months. Not dramatically. Not overnight. But consistently.

B2B operators—agencies, tour operators, hotel distributors—started asking different questions.

Not "which channels should we be on?" but "how do we make our inventory programmatically accessible?"

Not "how do we compete with OTAs?" but "how do we become infrastructure that platforms can plug into?"

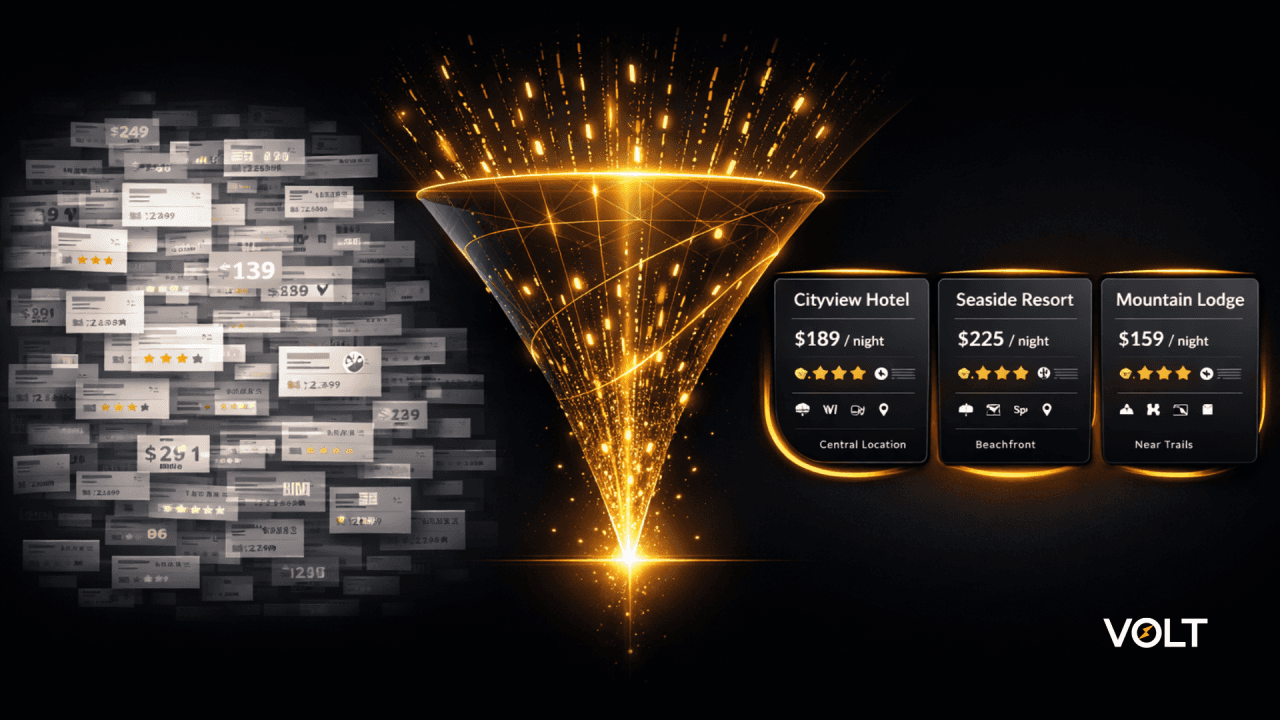

The trigger wasn't a single technology. It was accumulation. More automated booking flows. More agent-mediated discovery. More demand for real-time pricing and dynamic packaging. More platforms treating travel like composable infrastructure rather than curated catalogs.

Phocuswright reports 61% of travel brands testing or scaling autonomous booking systems. IDC estimates 30% of bookings will be executed programmatically by 2030. The language is different—agentic AI, agent-to-agent protocols—but the pattern is the same.

Travel is becoming an API problem.

What Actually Changes

When distribution moves from channel relationships to programmatic access, the operational requirements shift.

From negotiated rates to real-time pricing.

Static contracts don't work when demand fluctuates hourly. Platforms want dynamic responses, not cached inventories from yesterday.

From content dumps to structured data.

Rich schema matters. Not just room types and prices, but sustainability tags, amenity breakdowns, cancellation logic. The platforms building on top need machine-readable signals, not marketing copy.

From manual integrations to modular endpoints.

Every new connection shouldn't require custom middleware. The operators moving fastest are those whose systems already expose clean, documented APIs that new platforms can integrate in days, not quarters.

From channel dependency to direct flow.

When your infrastructure is accessible, you stop routing through intermediaries by default. Direct bookings increase. Commission leakage decreases. You control the relationship.

This isn't theoretical. Corporate travel platforms are rebuilding on composable stacks. Tour operators are shifting from monolithic systems to modular providers. Hotel distributors are moving inventory management into real-time engines because batch updates can't keep up.

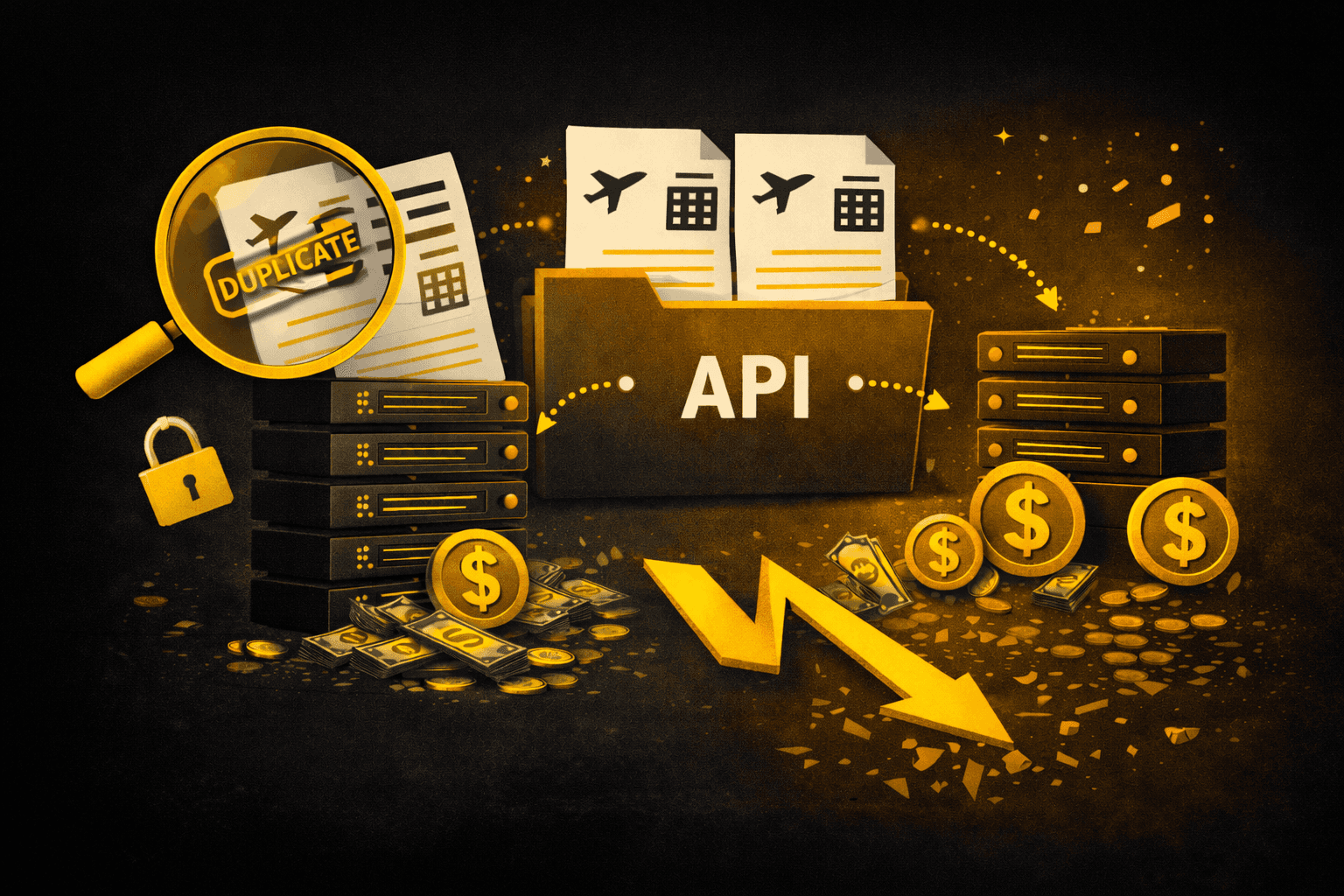

The Margin Question

OTA commissions range between 15-25%. For B2B players operating on thin wholesale margins, that's not just a cost—it's structural pressure.

When a programmatic integration reduces your dependency on OTA routing by even 20%, you recover margin. When you can fulfill direct bookings at scale without manual overhead, economics improve.

The constraint isn't eliminating OTAs. It's having infrastructure that doesn't force you through them by default.

What Readiness Looks Like

The operators positioning for this shift aren't chasing trends. They're solving for access.

Real-time availability and pricing. Not batch files. Not cached snapshots. Live queries that reflect current state.

Structured, machine-readable content. Clean schemas. Standardized formats. No PDFs, no unstructured text blobs.

Modular integration points. APIs that platforms can connect to without custom builds. Low friction, high reliability.

Predictable performance. Response times that don't degrade under load. Uptime that booking flows can depend on.

This isn't a rip-and-replace project. It's iterative. Start with one product vertical. Expose clean APIs. Test with a platform partner. Measure direct booking lift. Expand.

The timeline isn't 90 days or six months. It's continuous refinement. The goal isn't perfection—it's being accessible when demand shifts toward programmatic fulfillment.

Where This Goes

Distribution won't collapse into a single model. OTAs will remain relevant for certain use cases. GDS will continue to serve corporate travel. Wholesale relationships will persist.

But the center of gravity is moving. The platforms being built today—whether for corporate travel, tours, or specialty segments—default to API-first architectures. They expect real-time data. They optimize for programmatic booking flows.

If your infrastructure isn't built for that access model, you're friction. And friction gets routed around.

The question isn't whether to prepare for programmatic distribution. It's whether you're already prepared when platforms start expecting it.

At Volt, we build for operators who see this shift clearly. Modular APIs. Real-time orchestration. Clean integration paths. Infrastructure that doesn't force you through intermediaries by default.

Not because distribution is dying. Because it's evolving.