Travel Trends 2025: Strategic Imperatives for B2B Travel Companies

The travel industry stands at an inflection point. As we advance through 2025, B2B travel companies face unprecedented opportunities—and challenges—that will determine market leadership for the next decade. This comprehensive analysis examines seven transformative trends reshaping the industry landscape.

Executive Summary

The global travel industry, valued at over $1.4 trillion in 2024, is experiencing rapid transformation driven by technological innovation, evolving corporate priorities, and shifting consumer expectations. Our analysis reveals that companies implementing AI-driven personalization see average conversion increases of 25-40%, while those prioritizing sustainability report 30% higher customer retention rates among millennial and Gen Z travelers.

This report provides actionable insights for B2B travel decision-makers seeking to capitalize on emerging opportunities while mitigating industry disruption risks.

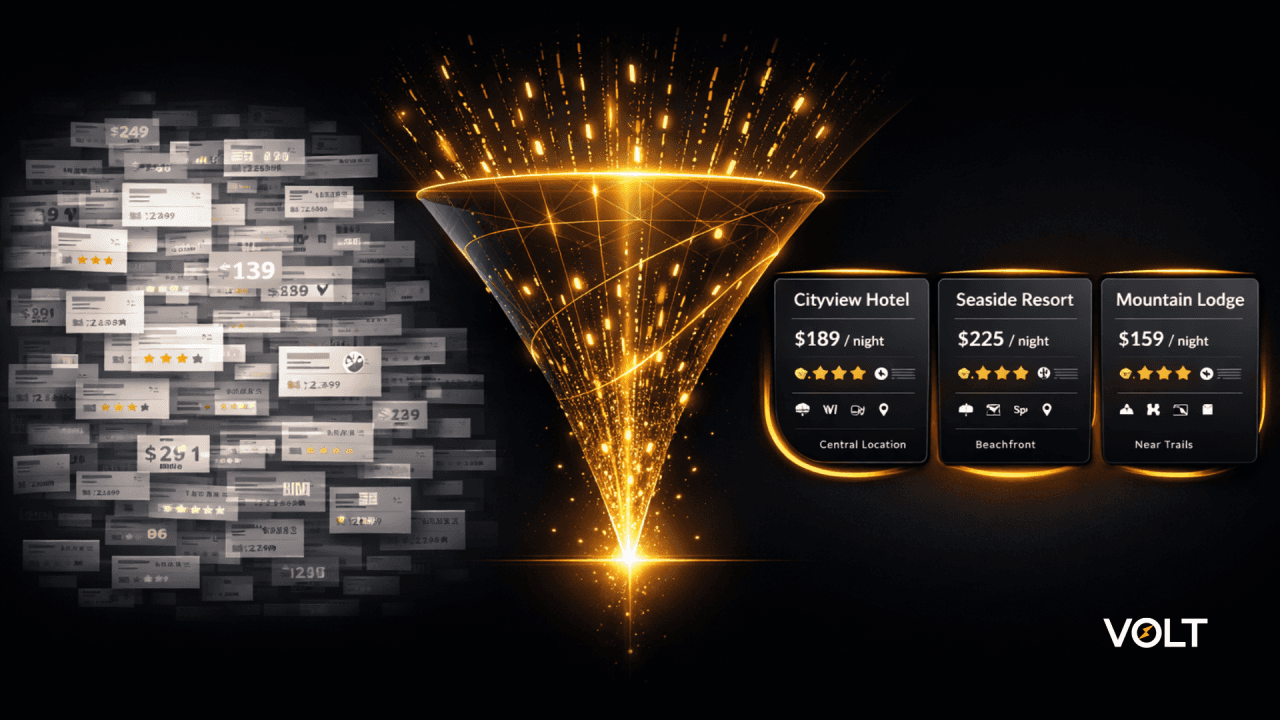

1. AI-Powered Hyper-Personalization: The New Competitive Advantage

The Current Landscape

Artificial Intelligence has evolved from experimental technology to mission-critical infrastructure. By 2025, companies leveraging advanced AI personalization report significantly higher customer lifetime values and reduced acquisition costs.

Market Impact:

Expedia Group: 25% conversion increase through AI-driven recommendations

Booking.com: 15% improvement in customer satisfaction scores

Amadeus: 30% reduction in booking abandonment rates

Implementation Framework

Phase 1: Data Integration

Consolidate customer touchpoints across all channels

Implement real-time behavioral tracking

Establish data governance protocols for privacy compliance

Phase 2: AI Model Development

Deploy machine learning algorithms for preference prediction

Integrate natural language processing for customer service

Implement dynamic pricing optimization

Phase 3: Personalization at Scale

Create individualized travel recommendations

Develop predictive customer service interventions

Launch automated marketing campaign optimization

ROI Projections

Companies implementing comprehensive AI personalization typically see:

20-30% increase in direct booking conversions

15-25% improvement in customer retention

10-20% reduction in customer acquisition costs

Strategic Recommendation: Allocate 15-20% of technology budget to AI initiatives within the next 18 months to maintain competitive positioning.

2. Sustainability: From Corporate Responsibility to Revenue Driver

The Business Case for Green Travel

Sustainability has transformed from a marketing differentiator to a fundamental business requirement. Research indicates that 73% of business travelers consider environmental impact when making booking decisions, with this figure rising to 86% among travelers under 35.

Industry Leaders Setting the Standard

Accor Hotels: Carbon neutrality by 2030, 40% reduction in water consumption

Result: 22% increase in corporate bookings from sustainability-focused companies

Marriott International: $0.5 billion investment in renewable energy

Result: 18% improvement in brand preference among corporate clients

Air France-KLM: 50% reduction in CO2 emissions per passenger-kilometer by 2030

Result: 25% increase in corporate partnership agreements

Implementation Strategy

Immediate Actions (0-6 months):

Conduct comprehensive carbon footprint assessment

Implement waste reduction programs

Partner with certified eco-friendly suppliers

Medium-term Goals (6-18 months):

Achieve third-party sustainability certifications

Launch carbon offset programs for customers

Develop transparent sustainability reporting

Long-term Vision (18+ months):

Integrate renewable energy sources

Establish circular economy practices

Create sustainability-linked revenue streams

Financial Impact: Companies with robust sustainability programs report 12-18% premium pricing power and 25% higher customer retention rates.

3. Bleisure Travel: Capturing the $300 Billion Opportunity

Market Dynamics

The bleisure travel segment represents one of the fastest-growing opportunities in business travel, with market size projected to reach $300 billion by 2026. This trend reflects fundamental shifts in work-life integration and employee value propositions.

Success Stories and Strategies

Hilton Worldwide:

Launched "Work from Hilton" program

35% increase in extended stays

Average revenue per guest increase of 28%

American Express Global Business Travel:

Developed integrated bleisure booking platform

40% growth in multi-day corporate bookings

Client satisfaction scores improved by 22%

Revenue Optimization Framework

Product Development:

Create flexible itinerary packages

Develop family-friendly corporate accommodations

Offer weekend extension incentives

Technology Integration:

Build seamless expense management systems

Implement approval workflows for extended stays

Create mobile-first booking experiences

Partnership Strategy:

Collaborate with local experience providers

Establish corporate rates for leisure activities

Develop loyalty program crossover benefits

Expected Outcomes: Companies successfully capturing bleisure demand report 20-35% increases in booking values and 15% improvements in customer lifetime value.

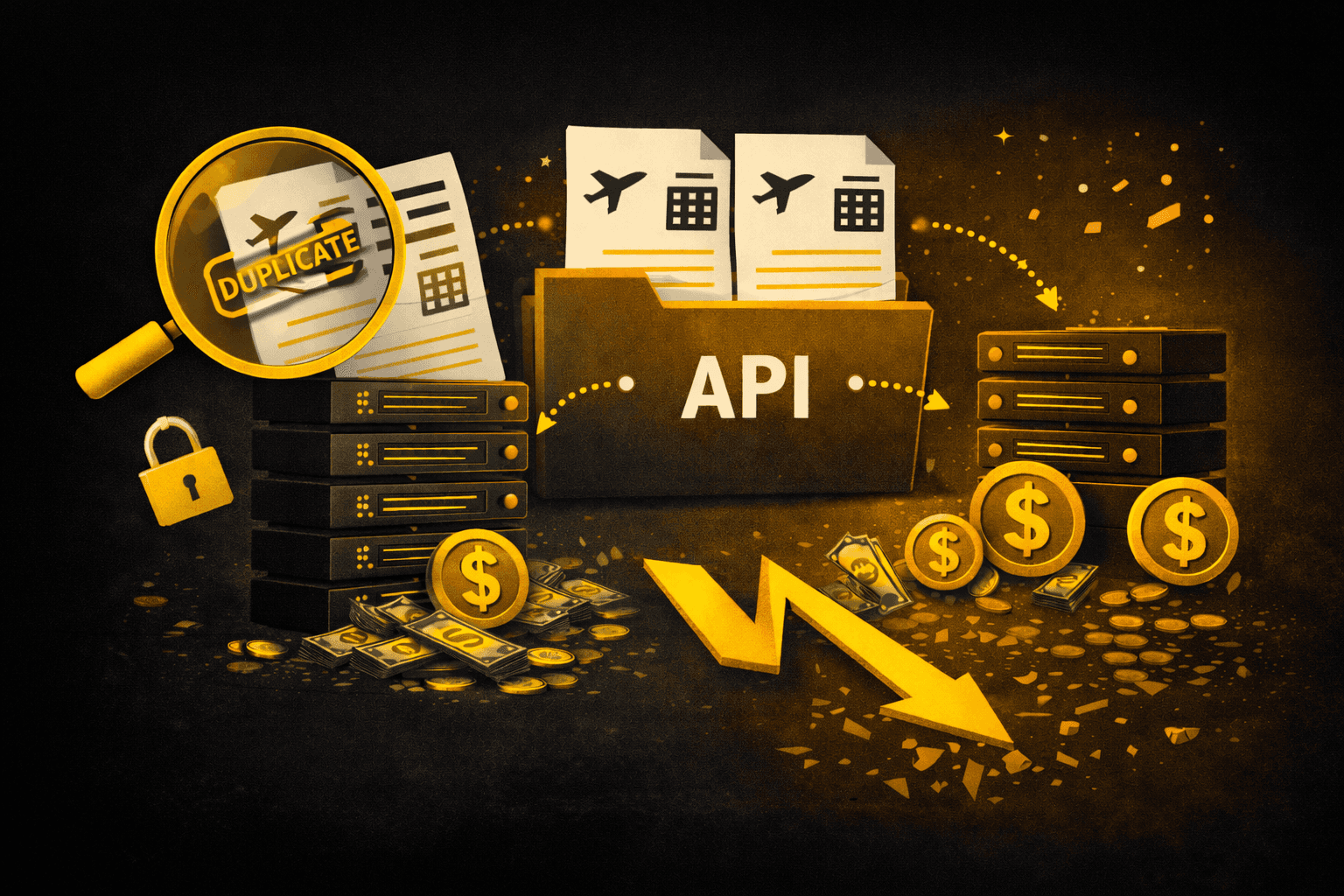

4. Frictionless Digital Experiences: The New Standard

Technology Infrastructure Requirements

Digital transformation in travel extends beyond basic online booking to encompass the entire customer journey. Leading companies invest 12-15% of revenue in digital infrastructure to maintain competitive advantage.

Innovation Benchmarks

Singapore Changi Airport:

Fully automated check-in and boarding processes

45% reduction in passenger processing time

92% customer satisfaction rating for digital services

Delta Air Lines:

Biometric boarding at 35+ airports

25% improvement in on-time departures

$50 million annual operational cost savings

Digital Transformation Roadmap

Foundation Layer:

Cloud-based infrastructure migration

API-first architecture implementation

Real-time data synchronization across platforms

Experience Layer:

Mobile-optimized interfaces

Contactless payment integration

Predictive service delivery

Intelligence Layer:

IoT sensor integration

Automated customer service

Predictive maintenance systems

Investment Framework: Allocate 8-12% of annual revenue to digital transformation initiatives, with expected ROI of 200-300% within 24 months.

5. Corporate Travel Evolution: Adapting to New Realities

Shifting Corporate Priorities

Post-pandemic corporate travel emphasizes duty of care, flexibility, and employee well-being. Companies report that travel policy satisfaction directly correlates with employee retention and productivity.

Market-Leading Approaches

American Express Global Business Travel:

Real-time health and safety monitoring

24/7 traveler support services

Flexible booking and cancellation policies

Result: 30% increase in client retention

SAP Concur:

Integrated expense and risk management

Automated policy compliance

Mobile-first traveler experience

Result: 25% reduction in travel program administration costs

Strategic Implementation

Policy Innovation:

Implement flexible booking windows

Develop comprehensive health protocols

Create transparent communication channels

Technology Integration:

Deploy real-time traveler tracking

Implement automated expense reporting

Establish mobile-first service delivery

Vendor Management:

Establish preferred supplier networks

Negotiate flexible contract terms

Implement performance-based partnerships

Business Impact: Companies with modernized corporate travel programs report 18-25% improvements in employee satisfaction and 12-20% reductions in total travel costs.

6. Data-Driven Decision Making: The Strategic Imperative

The Analytics Revolution

Advanced analytics and machine learning enable travel companies to optimize operations, predict demand patterns, and personalize customer experiences at unprecedented scale.

Industry Applications

Revenue Management:

Dynamic pricing optimization: 15-30% revenue increases

Demand forecasting: 25% improvement in capacity utilization

Inventory optimization: 20% reduction in unsold inventory

Customer Intelligence:

Behavioral prediction: 35% improvement in marketing ROI

Churn prevention: 40% reduction in customer attrition

Personalization: 25% increase in cross-sell success rates

Implementation Architecture

Data Collection:

Multi-channel customer touchpoint integration

Real-time behavioral tracking

Third-party data source incorporation

Analysis Framework:

Predictive modeling for demand forecasting

Customer segmentation and lifetime value calculation

Competitive intelligence and market analysis

Decision Support:

Automated pricing and inventory optimization

Personalized marketing campaign deployment

Operational efficiency improvements

ROI Expectations: Companies implementing comprehensive data analytics report 200-400% ROI within 18-24 months.

7. Emerging Markets: The Next Growth Frontier

Market Opportunity Assessment

Emerging markets in Asia-Pacific, Africa, and the Middle East represent $200+ billion in untapped travel demand, driven by expanding middle classes and infrastructure development.

Regional Market Analysis

Asia-Pacific:

Market size: $150 billion by 2027

Growth rate: 12-15% annually

Key drivers: Business expansion, infrastructure development

Middle East:

Market size: $45 billion by 2027

Growth rate: 10-12% annually

Key drivers: Economic diversification, mega-events

Africa:

Market size: $35 billion by 2027

Growth rate: 8-10% annually

Key drivers: Resource development, regional integration

Market Entry Strategies

Partnership Approach:

Local joint ventures and strategic alliances

Regional payment method integration

Cultural adaptation of service offerings

Technology Localization:

Multi-language platform development

Regional compliance and regulatory adherence

Local customer service infrastructure

Investment Framework:

Phased market entry with milestone-based expansion

Risk mitigation through diversified regional presence

Performance measurement and optimization

Growth Projections: Companies successfully expanding into emerging markets report 25-40% increases in total addressable market and 15-30% improvements in growth rates.

Strategic Implementation Timeline

Immediate Priorities (0-6 months)

Conduct comprehensive market analysis and competitive benchmarking

Assess current technology infrastructure and identify gaps

Develop sustainability roadmap and begin implementation

Launch AI personalization pilot programs

Medium-term Objectives (6-18 months)

Deploy comprehensive digital transformation initiatives

Establish emerging market partnerships and entry strategies

Implement advanced data analytics capabilities

Launch bleisure travel product offerings

Long-term Vision (18+ months)

Achieve market leadership in targeted segments

Establish sustainable competitive advantages

Expand global footprint through strategic initiatives

Drive industry innovation and standard-setting

Conclusion: Seizing the Transformation Opportunity

The travel industry's transformation presents both unprecedented opportunities and significant risks. Companies that proactively adapt to these seven critical trends will establish sustainable competitive advantages and drive superior financial performance.

Key Success Factors:

Investment in Technology: Allocate 12-18% of revenue to digital transformation and AI initiatives

Sustainability Leadership: Implement comprehensive environmental programs that drive both impact and revenue

Customer-Centricity: Develop personalized, frictionless experiences that exceed evolving expectations

Global Expansion: Strategically enter emerging markets while maintaining operational excellence

Data-Driven Culture: Establish analytics capabilities that inform all strategic decisions

The companies that will thrive in this new landscape are those that view these trends not as challenges to manage, but as opportunities to lead industry evolution and capture disproportionate value creation.

For B2B travel leaders, the question isn't whether to adapt—it's how quickly you can transform your organization to capture the opportunities that define the next decade of industry growth.

About This Analysis: This report synthesizes insights from leading industry research, company performance data, and strategic interviews with travel industry executives. Data sources include McKinsey Global Institute, Deloitte Travel & Hospitality, and proprietary market research.